Anti Money Laundering (Risk-Based Approach, Customer Due Diligence)

Free PDF Certificate+Free Life coaching Course included | Free Retake Exam | Instant Access | Lifetime Access

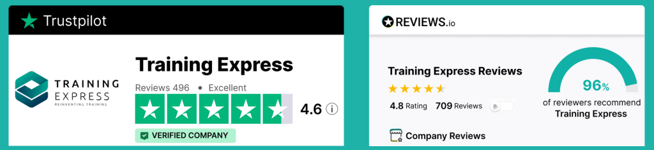

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Navigating the intricate landscape of financial regulations can be a daunting task, especially when it comes to combating the pervasive issue of money laundering. Unravelling the complexities of legislation such as the Proceeds of Crime Act 2002 can feel like a maze, leaving professionals in the financial sector grappling with a sense of frustration and uncertainty.

The burden of compliance and the responsibility placed on Money Laundering Reporting Officers can be overwhelming, demanding a comprehensive understanding of evolving anti money laundering regulations.

Elevate your awareness and hone your skills through insightful training, emerging not just compliant but empowered against financial crime. Enrol now and overcome the complexities with confidence, emerging as a vigilant guardian in the realm of financial integrity.

Key Features of the Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) Course

- CPD Certified Anti Money Laundering (Risk-Based Approach, Customer Due Diligence)

- FREE Instant e-certificate and hard copy included

- Fully online, interactive course with audio voiceover

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Tutor Support to everyone

- Lifetime Access to the Anti Money Laundering (Risk-Based Approach, Customer Due Diligence)

Additional Gifts with the Anti Money Laundering (Risk-Based Approach, Customer Due Diligence)

Free Life coaching Course

CPD

Course media

Resources

- Training Express Brochure - download

Description

Amidst these challenges, there's a beacon of knowledge and empowerment – a specialised course designed to equip you with the expertise needed to navigate these murky waters. Delve into the core principles of the risk-based approach, discovering a strategic framework that not only meets regulatory requirements but also enhances your organisation's resilience against illicit financial activities.

Learn the art of effective Customer Due Diligence, mastering the skills to identify and mitigate risks. This course transcends theoretical frameworks; it's a dynamic journey that transforms frustration into capability. From record-keeping intricacies to recognising suspicious conduct, each module seamlessly weaves together, providing a holistic understanding of anti money laundering practices.

Identify and respond to suspicious conduct and transactions with precision. Elevate your awareness and knowledge through targeted training, equipping yourself with the expertise needed to safeguard against financial malfeasance.

In a world where financial vigilance is paramount, our Anti Money Laundering course stands as your trusted ally. Gain the confidence to navigate this complex terrain, protecting your institution and ensuring compliance with finesse.

Course Curriculum of the Anti Money Laundering (Risk-Based Approach, Customer Due Diligence)

Module 01: Introduction to Money Laundering

In this introductory module, we will develop our understanding of what money laundering is and will explore the three stages of money laundering in detail.

Module 02: Proceeds of Crime Act 2002

In module two, we will learn the principles of the Proceeds of Crime Act 2002 and discuss the notions and elements of criminal property. It covers the concealing offense, arranging office and the Acquisition, Use and Possession Offence.

Module 03: Development of Anti Money Laundering Regulation

In module three, we will familiarise with terrorist legislation and take a more in-depth look at The Proceeds of Crime Act 2002. It provides essential information on the second, third, fourth and fifth Money Laundering Directive.

Module 04: Responsibility of the Money Laundering Reporting Officer

In module four, we will learn about the role of the money laundering reporting officer and the information that needs to be included in the MLRO’s Annual Report. It also covers internal reporting procedures.

Module 05: Risk-based Approach

In module five, we will develop our understanding of customer due diligence and the main factors to consider when determining AML risk. It also provides step-by-step guidance on how to assess client risk.

Module 06: Customer Due Diligence

In module six, we will explore the key elements needed in a customer due to diligence program, from account opening to customer identification and verification. It also covers consolidated KYC risk management.

Module 07: Record Keeping

In module seven, we will look at record-keeping procedures and best practices, including in what form records should be kept and the consequences of failure to keep records.

Module 08: Suspicious Conduct and Transactions

In module eight, we will gain an in-depth understanding of what constitutes suspicious activity and what to do if customer activity appears suspicious, as well as the types of events that may cause suspicion.

Module 09: Awareness and Training

In module nine, we will take a look at the legal requirements for staff training and awareness, including the responsibilities of senior staff. A wide range of training methods will be explored, as well as key assessment procedures.

Learning Outcomes:

- Analyse historical money laundering trends for informed risk assessment.

- Demonstrate proficiency in implementing a risk-based approach.

- Execute thorough Customer Due Diligence to mitigate potential risks.

- Effectively manage and maintain comprehensive record-keeping systems.

- Identify and report suspicious conduct and transactions.

- Foster a culture of awareness and compliance through strategic training.

Accreditation

All of our courses, including this Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course, are fully accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in Anti Money Laundering (Risk-Based Approach, Customer Due Diligence).

Certification

Once you’ve successfully completed your Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) certification have no expiry dates, although we do recommend that you renew them every 12 months.

Assessment

At the end of the Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course, there will be an online assessment, which you will need to pass to complete the course. Answers are marked instantly and automatically, allowing you to know straight away whether you have passed. If you haven’t, there’s no limit on the number of times you can take the final exam. All this is included in the one-time fee you paid for the course itself.

Who is this course for?

This Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course is ideal for:

- Finance Professionals

- Compliance Officers

- Legal Experts

- Risk Management Specialists

- Banking Executives

- Auditors

- Law Enforcement Personnel

- Regulatory Affairs Professionals

Requirements

Learners do not require any prior qualifications to enrol on this Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course. You just need to have an interest in Anti Money Laundering (Risk-Based Approach, Customer Due Diligence).

.

Career path

After completing this course you will have a variety of careers to choose from. The following job sectors of Anti Money Laundering (Risk-Based Approach, Customer Due Diligence) course are:

- Financial Crime Analyst

- Compliance Manager

- Risk Assessment Officer

- Fraud Investigator

- Anti Money Laundering Specialist

- Regulatory Compliance Advisor

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.