Anti-Money Laundering (AML) Regulation Training

Free PDF Certificate included + Free Life Coaching Course + CPD Certified | Free Retake Exam | Lifetime access

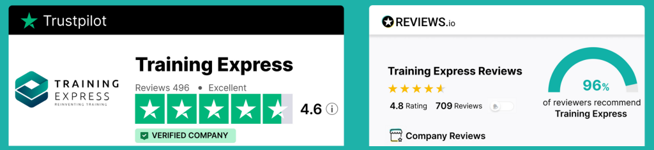

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

✩ Trusted by Over 10K Business Partners & 1 Million Students Around the World! ✩

Are you ready to delve into the critical realm of Anti-Money Laundering (AML) Regulation? In today's financial landscape, expertise in AML compliance is not just valuable—it's essential. With significant sectors like banking, finance, and legal services emphasizing stringent AML protocols, now is the ideal moment to enhance your professional credentials in this burgeoning field.

Introducing our "Anti-Money Laundering (AML) Regulation Training," a comprehensive program designed to equip you with the knowledge and skills needed to navigate the complexities of financial crime prevention. From understanding the fundamentals of money laundering to mastering the intricacies of the Proceeds of Crime Act 2002, each module is meticulously crafted to ensure you grasp the nuances of AML regulation.

Led by industry experts, this course covers essential topics such as the role of the Money Laundering Reporting Officer, implementing a risk-based approach, conducting thorough Customer Due Diligence, maintaining meticulous record-keeping practices, and identifying suspicious conduct and transactions. Moreover, it emphasizes the importance of continuous awareness and training to stay ahead in this evolving regulatory landscape.

In terms of career prospects, professionals in AML compliance command competitive salaries, with entry-level positions typically starting around £25,000 to £35,000 annually, and experienced professionals earning significantly more, often exceeding £70,000 depending on seniority and industry. The sector shows robust growth, with an increasing demand for AML specialists across various industries, reflecting a notable rise in compliance regulations and financial crime prevention efforts by up to 7% annually.

Prepare yourself for a rewarding career path in AML compliance. Are you ready to embark on this transformative journey?

Learning Outcomes:

- Understand money laundering concepts.

- Learn the Proceeds of Crime Act 2002.

- Explore AML regulation development.

- Discover Money Laundering Reporting Officer responsibilities.

- Apply a risk-based approach to AML.

- Perform customer due diligence.

- Maintain accurate record keeping.

- Identify and report suspicious activities.

Key Features of the Anti-Money Laundering Regulation Training Course :

- Accredited by CPD

- Instant e-certificate and hard copy dispatch by next working day

- Fully online, interactive course with audio voiceover

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

*** Additional Gifts ***

- Free Life Coaching Course

*** (Offer Ends Soon) ***

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

CPD

Course media

Resources

- Training Express Brochure - download

Description

Course Curriculum

The detailed curriculum outline of this Anti-Money Laundering (AML) course is as follows:

***Anti-Money Laundering (AML) Regulation Training***

- Module 01: Introduction to Money Laundering

- Module 02: Proceeds of Crime Act 2002

- Module 03: Development of Anti-Money Laundering Regulation

- Module 04: Responsibility of the Money Laundering Reporting Officer

- Module 05: Risk-based Approach

- Module 06: Customer Due Diligence

- Module 07: Record Keeping

- Module 08: Suspicious Conduct and Transactions

- Module 09: Awareness and Training

Accreditation

All of our courses are fully accredited, including this Anti-Money Laundering (AML) Course, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in Anti-Money Laundering (AML).

Certification

Once you’ve successfully completed your Anti-Money Laundering (AML) Course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our Anti-Money Laundering (AML) Course certification has no expiry dates, although we do recommend that you renew them every 12 months.

Assessment

At the end of the course, there will be an online assessment, which you will need to pass to complete the course. Answers are marked instantly and automatically, allowing you to know straight away whether you have passed. If you haven’t, there’s no limit on the number of times you can take the final exam. All this is included in the one-time fee you paid for the course itself.

Who is this course for?

This Anti-Money Laundering (AML) Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this Anti-Money Laundering (AML) Course is ideal for:

- Compliance officers.

- Financial crime analysts.

- Risk managers.

- Accountants and auditors.

- Financial service professionals.

- Legal professionals.

Requirements

Learners do not require any prior qualifications to enrol on this Anti-Money Laundering (AML) Course. You just need to have an interest in Anti-Money Laundering (AML) Course.

Career path

After completing this Anti-Money Laundering (AML) Course you will have a variety of careers to choose from. The following job sectors of AML Course are:

- Compliance Officer - £30-50k/year.

- Financial Crime Analyst - £30-45k/year.

- Money Laundering Reporting Officer - £45-70k/year.

- Risk Manager - £45-65k/year.

- Anti-Money Laundering Investigator - £35-55k/year.

- AML Training Manager - £40-60k/year.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.