Business Simulation | Financial & Commercial Awareness

In-house course utilising exeriential learning

Financial Fluency

Summary

- Certificate of completion - Free

- Tutor is available to students

Add to basket or enquire

Overview

A unique, memorable, interactive and experiential in-house training experience.

Delegates simulate running real businesses and learn key finance and commercial skills.

Key Features of a Business Simulations

- Small teams compete in an open market.

- They run through several business cycles, experience critical business decisions and inter-dependencies and face the consequences of their decisions.

- This enables delegates to experiment with a realistic model of a business away from their desks.

Certificates

Certificate of completion

Digital certificate - Included

Course media

Description

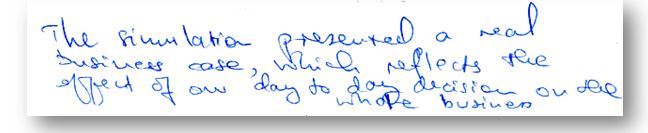

Business Simulations are a unique experience. They make a real difference both in terms of learning and translation of skills back into the work place.

Our business simulations cover a wide range of industries and learning outcomes. Suitable for all levels of experience and seniority, we tailor our simulations so they are pitched at the right level for each client and their team.

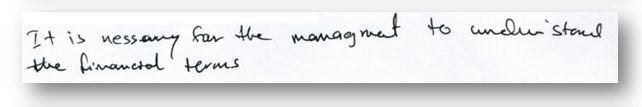

Our business simulations are relevant for both finance and non-finance professionals.

Our business simulations provide a uniquely powerful way to learn about business and finance. They enable participants see how business decisions impact on finance and how finance decisions impact on business.

What will you learn on a Business Simulation Course?

In small teams, you will operate a business and make decisions regarding business and financial strategy. Over successive periods you will see the connection between your decisions and the financial results of your business.

There is a clear link between decisions, such as offering value products and investing in quality and the success of these strategies.

Our business simulations ensure that those in different parts an organisation understand how they integrate with other parts of the business and impact on the business as a whole.

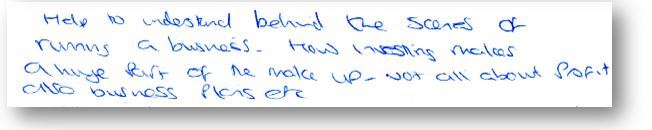

Our simulations facilitate experiential learning (learning by doing) principles.

The interactive training environment powerfully enables people to absorb essential concepts, change their behaviour and transfer these skills directly back to their own businesses. Our business simulations can be tailored to your organisation.

Typical Learning Outcomes for a Business Simulations

- The purpose and use of financial statements

- How money flows around a business

- The importance of managing cash

- How each area of a business affects overall financial results

- The impact of different business decisions and strategies

- The impact of financial issues on businesses

- Financing a business and in particular working capital.

Tailored Business Simulations Courses

All our courses are tailored to meet our client's specific needs. We like to spend time getting to know our clients and understand your learning objectives. From experience we know that training is most effective and valuable when tailored and focused.

In-house course

Please note this is an in-house corporate course offered directly to groups of people within organisations. This course is not for individual learners.

Who is this course for?

Business professionals.

Simulations work particualrly well with non-finance professionals however they are also suitable for finance professionals. The learning outcomes can be tailored accordingly.

Simulations are suitable for any level within an organisation from graduate through to board level.

Requirements

None

Questions and answers

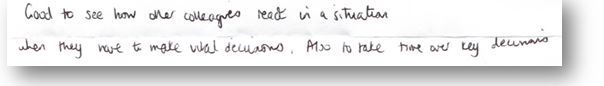

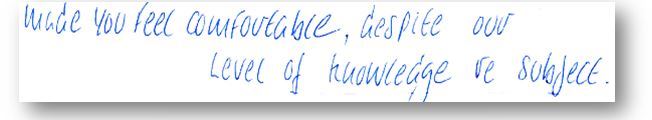

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on Reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.