Central Banking Monetary Policy

Super Saving Deal !! FREE PDF Certificate | Diploma Training | Advance Learning Materials | Expert Support

Janets

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Do you want to understand the complex world of central banking monetary policy? Look no further! Our Central Banking Monetary Policy course explores the various tools and techniques used by central banks to manage and influence the money supply.

Central Banking Monetary Policy is a course that focuses on the tools and techniques used by central banks to manage the money supply and interest rates. It discusses the monetary policy's theoretical and empirical underpinnings, the mechanics of how it is put into practice, and how it affects economic activity.

Topics covered in this Central Banking Monetary Policy course include:

Central Banking Overview: The background, evolution, and economic significance of central banking.

Monetary Policy Instruments: The tools that central banks use to control the amount of money in circulation, including open market operations, reserve standards, and the discount rate.

The effects of monetary policy on inflation, interest rates, economic growth, and financial stability.

International Monetary Policy: The central banks' function in the global financial system, including capital flows and exchange rate regimes.

The course also looks at how central banks contribute to financial stability and how monetary and fiscal policy interact. Students should comprehend the financial and economic ramifications of central banking monetary policy at the end of the course.

So, don't wait up. Enrol in our Central Banking Monetary Policy course now!

Learning outcomes

- Be aware of how central banks formulate and carry out monetary policies, as well as their goals.

- Gain knowledge of the theoretical and practical facets of monetary policy, as well as how it affects the economy.

- Examine how monetary policy has affected the macroeconomic setting and financial markets.

- Recognise the efficiency of the tools employed by central banks to carry out monetary policy.

- Be familiar with the global implications of central banking and monetary policy.

- Consider the risks and difficulties involved in monetary policy decisions.

- Analyse the effects on the economy and the efficacy of various monetary policies.

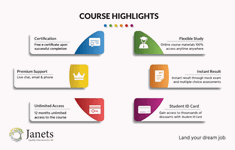

What You Get Out Of Studying With Janets

- Free PDF certificate upon successful completion of the Central Banking Monetary Policy course

- Full one-year access to Central Banking Monetary Policy course materials

- Instant assessment results

- Full tutor support available from Monday to Friday

- Study the Central Banking Monetary Policy course at your own pace

- Accessible, informative modules taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the Central Banking Monetary Policy training

- Study at your own time through your computer, tablet or mobile device

- Improve your chance of gaining valuable skills by completing the Central Banking Monetary Policy course

CPD

Course media

Description

The course is delivered through Janets’ online learning platform. The Central Banking Monetary Policy has no formal teaching deadlines, meaning you are free to complete the course at your own pace.

Course Modules

- Module 01: The History Of Central Banking And International Monetary System

- Module 02: Modern Central Banking Roles And Functions

- Module 03: Monetary Policy Implementation In Financial Market Operations

- Module 04: Money Creation In The Modern Economy

- Module 05: The Monetary Policy Transmission Mechanism

- Module 06: Financial Stability: Monitoring And Identifying Risks

- Module 07: Challenges For Central Banking

- Module 08: Optimal Monetary Policy Operations In Crisis Times

Method of Assessment

To successfully complete the course, students will have to take an automated multiple-choice exam. This exam will be online and you will need to score 60% or above to pass the course.

After successfully passing the course exam, you will be able to apply for a certificate as proof of your expertise.

Certification

All students who successfully complete the course can instantly download their free e-certificate. You can also purchase a hard copy of the certificate, which will be delivered by post for £9.99.

Who is this course for?

The course is ideal for those who are interested or already working in this sector.

Requirements

No prior qualifications are needed for Learners to enrol on this course.

Career path

Following professions are most popular in this sector

- Monetary Policy Analyst

- Central Bank Economist

- Monetary Policy Strategist

- Monetary Policy Manager

- Financial Analyst

The salary range for Central Banking Monetary Policy Professionals in the UK is typically between £90,000 and £120,000.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.