Double-Entry Accounting System

CPD Accredited | Free PDF & Hard Copy Certificate included | Free Retake Exam | Lifetime Access

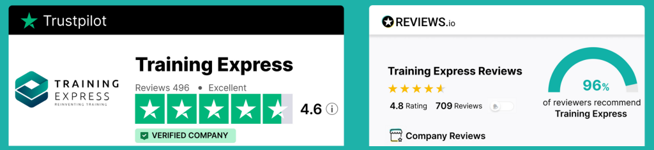

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Do you want to learn how to do the Double-Entry Accounting System in an easy way and never forget it? Then our Double-Entry Accounting System course is what you are looking for!

Along with the Double-Entry Accounting System, learn Balance Sheets, Income and Financial statements and Cash Flow and Profit & Loss statements.

Say goodbye to guesswork and hello to financial clarity! Enrol now and take the first step towards unlocking your full potential!

Key Benefits

- Accredited by CPD

- Instant e-certificate

- Fully online, interactive course

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

CPD

Course media

Resources

- Training Express Brochure - download

Description

Course Curriculum

- Module 01: Introduction to Accounting

- Module 02: Accounting Concepts and Standards

- Module 03: Double Entry Accounting

- Module 04: Double-Entry Bookkeeping

- Module 05: Balance Sheet

- Module 06: Income statement

- Module 07: Financial statements

- Module 08: Cash Flow Statements

- Module 09: Understanding Profit and Loss Statement

Learning Outcomes:

- Understand accounting fundamentals and terminology for financial analysis and reporting.

- Apply double-entry accounting principles to record transactions accurately and efficiently.

- Analyse financial statements to assess an organisation's financial health and performance.

- Interpret balance sheets, income statements, and cash flow statements effectively.

- Evaluate profit and loss statements to determine business profitability and viability.

- Demonstrate comprehension of accounting standards and their application in business contexts.

Accreditation

All of our courses, including this course are fully accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field.

Certification

Once you’ve successfully completed your Course, you will immediately be sent your digital certificates. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we recommend renewing them every 12 months.

Who is this course for?

- Students pursuing accounting or finance degrees.

- Professionals seeking to enhance accounting knowledge and skills.

- Entrepreneurs and small business owners managing their finances.

- Individuals considering a career change into accounting or finance.

- Anyone interested in understanding financial statements and accounting principles.

Career path

- Accountant

- Financial Analyst

- Bookkeeper

- Auditor

- Budget Analyst

- Tax Advisor

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.