Internal Auditor Training - QLS Endorsed Mega Bundle

10 QLS Endorsed Courses | FREE QLS Hardcopy Certificates | FREE PDF Certificates | Tutor Support | Lifetime Access

Janets

Summary

- CPD PDF Certificate of Completion - Free

- QLS Endorsed Hardcopy Certificate - Free

- QLS PDF Certificate of Completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Amid the complex world of finance, financial integrity and regulatory compliance are the most important. This is where the Internal Auditors stand out. They safeguard organisations from the shadows of financial missteps and non-compliance. However, most internal auditors find it difficult, and the frustration isn't just dealing with the numbers. It's in the potential risks that lurk in the unseen corners of financial operations.

Enter the Internal Auditor Training bundle, through which you will explore Internal Audit Skills, Compliance Officer Training, Tax Accounting, Financial Analysis, and the nuanced expertise required to combat money laundering. Moreover, the Internal Auditor Training bundle covers the mysteries of financial statements and the complexities of financial investigation.

Want to gain the skills to dissect financial landscapes, ensure compliance, and foster financial resilience. Join this Internal Auditor Training bundle and not just learn to audit, audit with mastery.

Learning Outcome

By the end of this Internal Auditor Training bundle, you will be able to:

- Conduct internal audits proficiently to assess and improve compliance.

- Ensure adherence to regulations and mitigate legal risks effectively.

- Use accounting and finance skills to make informed managerial decisions.

- Demonstrate tax accounting expertise ensuring compliance with tax regulations.

- Explore financial investigation to help contribute to fraud detection.

- Create financial models with Excel to enhance data analysis capabilities.

- Apply financial advisor knowledge to assist clients in achieving their financial objectives.

- Implement anti-money laundering (AML) practices, detecting and preventing financial crimes and ensuring regulatory compliance.

- Analyse financial statements, interpret data, identify trends, and make financial decisions accordingly.

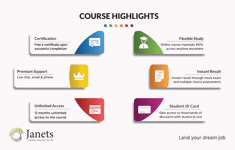

Standout features of studying with Janets:

- The ability to complete the Internal Auditor Training bundle at your own convenient time

- Online free tests and assessments to evaluate the progress

- Facility to study the Internal Auditor Training bundle from anywhere in the world by enrolling

- Get all the required study materials and supporting documentation after getting enrolled in Internal Auditor Training Bundle

- Get a free E-certificate, Transcript, and Student ID with Internal Auditor Training bundle

- Expert-designed Internal Auditor Training bundle with video lectures and 24/7 tutor support

Achievement

Certificates

CPD PDF Certificate of Completion

Digital certificate - Included

QLS Endorsed Hardcopy Certificate

Digital certificate - Included

QLS PDF Certificate of Completion

Digital certificate - Included

CPD

Course media

Description

The Internal Auditor Training bundle is designed for individuals seeking proficiency in internal auditing, compliance, and financial management. Participants will explore topics such as Accounting and Finance for Managers, Tax Accounting, Financial Advisor, Financial Modelling, and Financial Statement Analysis, along with areas like Anti-Money Laundering (AML) and Financial Investigation in this Internal Auditor bundle.

Learners will possess a well-rounded skill set, making them adept internal auditors capable of navigating complex financial landscapes, ensuring compliance, and contributing to effective financial decision-making within organisations.

This Internal Auditor Training - QLS Endorsed Mega Bundle Course has covered a total of 10 QLS Endorsed courses.

- Course 01: Internal Audit Skills at QLS Level 5

- Course 02: Diploma in Compliance Officer Training at QLS Level 5

- Course 03: Advanced Certificate in Accounting and Finance for Managers at QLS Level 3

- Course 04: Diploma in Tax Accounting at QLS Level 5

- Course 05: Diploma in Financial Advisor at QLS Level 4

- Course 06: Diploma in Anti-Money Laundering (AML) at QLS Level 5

- Course 07: Diploma in Financial Statement Analysis at QLS Level 5

- Course 08: Diploma in Financial Analysis at QLS Level 4

- Course 09: Certificate in Financial Investigator at QLS Level 3

- Course 10: Award in Financial Modelling With Excel at QLS Level 2

Method of Assessment

To successfully complete the courses, students will have to take an automated multiple-choice exam. This exam will be online, and you will need to score 60% or above to pass the course.

After successfully passing the course exam, you will be able to apply for a certificate as proof of your expertise.

Who is this course for?

This Internal Auditor Training bundle is designed for:

- Professionals seeking internal auditor skills, aspiring to assess and enhance organisational processes and compliance effectively.

- Individuals interested in compliance officer training, aiming to ensure regulatory adherence, ethical practices, and legal risk mitigation.

- Managers and aspiring financial professionals pursuing accounting and finance skills.

- Those looking for tax accounting expertise to manage financial records and ensure compliance with tax laws.

- Aspiring financial advisors committed to providing sound financial guidance and assisting clients in achieving financial goals.

Requirements

No prior qualifications are needed for Learners to enrol on this bundle.

Career path

This Internal Auditor Training bundle opens doors to many job and career opportunities. Here are a few:

- Internal Auditor (£30,000 - £45,000)

- Compliance Officer (£25,000 - £40,000)

- Financial Manager (£35,000 - £55,000)

- Tax Accountant (£28,000 - £45,000)

- Financial Advisor (£30,000 - £50,000)

- AML Specialist (£30,000 - £45,000)

- Financial Analyst (£30,000 - £50,000)

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on Reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.