Tax - Navigating Taxation and Tax Law

100% Success Rate | CPD Certified Diploma | FREE Digital Certificate | FREE Exam | 24/7 Tutor Support | Lifetime Access

Janets

Summary

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Struggling to find the right course? We got you covered with our Tax - Navigating Taxation and Tax Law bundle!

Enrol in our most sought-after Tax Accounting bundle which will set you apart from the rest .

If you're an enthusiastic learner looking to enhance your understanding in Tax Accounting then don't rush; instead, develop the relevant knowledge and skills with our bundle to make yourself stand out as a strong candidate in the job market.

Courses included in this Tax Accounting bundle are:

- Course 01: Tax Accounting

- Course 02: Bookkeeping And Financial Accounting

- Course 03: Management Accounting Tools

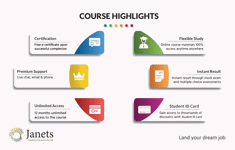

Standout features of studying Tax Accounting with Janets:

- The ability to complete the Tax Accounting at your own convenient time

- Online free tests and assessments to evaluate the progress

- Facility to study Tax Accounting from anywhere in the world by enroling

- Get all the required materials and documentation after getting enrolled in Life Coaching

- Get a free E-certificate, Transcript, and Student ID with Life Coaching

- Expert-designed Tax Accounting with video lectures and 24/7 tutor support

Certificates

Certificate of completion

Digital certificate - Included

Method of Assessment

To complete the bundle, students will have to take an automated multiple-choice exam for all the courses. These exams will be online and you will need to score 60% or above to pass. After passing the exams, you will be able to apply for the certificates.

- CPD Accredited Digital Certificates Included in the price

- Hardcopy 8.99 (With FREE UK Delivery)

CPD

Course media

Description

This career-focused Tax - Navigating Taxation and Tax Law bundle is formulated to make you a good fit for the employment market. Not only that, the proficiency that can be obtained after completing this Tax Accountingtraining will add value to your resume and catch the attention of the employers.So what are you waiting for enrol Tax Accountingbundle now and launch your career with a bang.

Who is this course for?

The Tax Accounting course is ideal for those who are interested or already working in this sector.

Requirements

No prior qualifications are needed for Learners to enrol on this Tax Accounting

Career path

After completing this Tax Accounting course, you will have the knowledge and skills to explore trendy and in-demand Tax Accounting jobs.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.