Xero & IK Payroll Management for Accountants - CPD Certified

Spring Sale Now On | 14 in 1 Exclusive Bundle| 145 CPD Points|Gifts: Hardcopy + PDF Certificate - Worth £160

Apex Learning

Summary

- Certificate of completion - Free

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

✿✿ Fall into Savings. Enjoy the biggest price fall this Autumn! ✿✿

Life Just Got Better This Summer! Get Hard Copy + PDF Certificates + Transcript + Student ID Card as a Gift - Enrol Now

Tired of browsing and searching for the course you are looking for? Can’t find the complete package that fulfils all your needs? Then don’t worry as you have just found the solution. Take a minute and look through this 14-in-1 extensive bundle that has everything you need to succeed in Xero and other relevant fields!

After surveying thousands of learners just like you and considering their valuable feedback, this all in one Xero bundle has been designed by industry experts. We prioritised what learners were looking for in a complete package and developed this in-demand Xero course that will enhance your skills and prepare you for the competitive job market.

Also, our Xero experts are available for answering your queries and help you along your learning journey. Advanced audiovisual learning modules of these courses are broken down into little chunks so that you can learn at your own pace without being overwhelmed by too much material at once.

Furthermore, to help you showcase your expertise in Xero, we have prepared a special gift of 1 hardcopy certificate and 1 PDF certificate for the title course completely free of cost. These certificates will enhance your credibility and encourage possible employers to pick you over the rest.

This Xero Bundle Consists of the following Premium courses:

- Course 01: Level 3 Xero Training

- Course 02: Payroll Management - Diploma

- Course 03: Introduction to Accounting

- Course 04: Accounting and Bookkeeping Level 2

- Course 05: Managerial Accounting Masterclass

- Course 06: Diploma in Quickbooks Bookkeeping

- Course 07: Theory of Constraints, Throughput Accounting and Lean Accounting

- Course 08: Internal Audit Training Diploma

- Course 09: Level 3 Tax Accounting

- Course 10: Team Management

- Course 11: Business Analysis Level 3

- Course 12: GDPR Data Protection Level 5

- Course 13: Microsoft Excel Training: Depreciation Accounting

- Course 14: Microsoft Excel Level 3

Benefits you’ll get choosing Apex Learning for this Xero:

- Pay once and get lifetime access to 14 CPD courses

- Certificates, student ID for the title course included in a one-time fee

- Free up your time — don’t waste time and money travelling for classes

- Accessible, informative modules designed by expert instructors

- Learn at your ease — anytime, from anywhere

- Study the course from your computer, tablet or mobile device

- CPD accredited course — improve the chance of gaining professional skills

How will I get my Certificate?

After successfully completing the course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement.

- PDF Certificate: Free (For The Title Course)

- Hard Copy Certificate: Free (For The Title Course)

Certificates

Certificate of completion

Digital certificate - Included

Certificate of completion

Hard copy certificate - Included

You will get the Hard Copy certificate for the title course (Level 3 Xero Training) absolutely Free! Other Hard Copy certificates are available for £10 each.

Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

CPD

Course media

Description

Curriculum of Xero Bundle

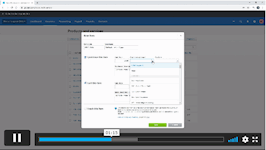

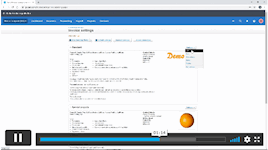

Course 01: Level 3 Xero Training

- Introduction

- Getting Started

- Invoices and Sales

- Bills and Purchases

- Bank Accounts

- Products and Services

- Fixed Assets

- Payroll

- VAT Returns

Course 02: Payroll Management - Diploma

Sage 50 Payroll for Beginners

- Module 1: Payroll Basics

- Module 2: Company Settings

- Module 3: Legislation Settings

- Module 4: Pension Scheme Basics

- Module 5: Pay Elements

- Module 6: The Processing Date

- Module 7: Adding Existing Employees

- Module 8: Adding New Employees

- Module 9: Payroll Processing Basics

- Module 10: Entering Payments

- Module 11: Pre-Update Reports

- Module 12: Updating Records

- Module 13: e-Submissions Basics

- Module 14: Process Payroll (November)

- Module 15: Employee Records and Reports

- Module 16: Editing Employee Records

- Module 17: Process Payroll (December)

- Module 18: Resetting Payments

- Module 19: Quick SSP

- Module 20: An Employee Leaves

- Module 21: Final Payroll Run

- Module 22: Reports and Historical Data

- Module 23: Year-End Procedures

Sage 50 Payroll Intermediate Level

- Module 1: The Outline View and Criteria

- Module 2: Global Changes

- Module 3: Timesheets

- Module 4: Departments and Analysis

- Module 5: Holiday Schemes

- Module 6: Recording Holidays

- Module 7: Absence Reasons

- Module 8: Statutory Sick Pay

- Module 9: Statutory Maternity Pay

- Module 10: Student Loans

- Module 11: Company Cars

- Module 12: Workplace Pensions

- Module 13: Holiday Funds

- Module 14: Roll Back

- Module 15: Passwords and Access Rights

- Module 16: Options and Links

- Module 17: Linking Payroll to Accounts

Course 03: Introduction to Accounting

Accounting Fundamental

- What is Financial Accounting

- Accounting Double Entry System and Fundamental Accounting Rules

- Financial Accounting Process and Financial Statements Generates

- Basic Accounting Equation and Four Financial Statements

- Define Chart of Accounts and Classify the accounts

- External and Internal Transactions with companies

- Short Exercise to Confirm what we learned in this section

Accounting Policies

- What are Major Accounting Policies need to be decided by companies

- Depreciation Policies

- Operational Fixed Asset Controls

- Inventory Accounting and Controls

- Revenue Accounting and Controls

Course 04: Accounting and Bookkeeping Level 2

- Introduction to the course

- Introduction to Bookkeeping

- Bookkeeping systems

- Basics of Bookkeeping

- The functionality of bookkeeping

- On a personal note

Course 05: Managerial Accounting Masterclass

Setion 1

- Manaerial Accounting Defined

- Financial Accounting Compared to Managerial Accounting

- Trends

- Foundation Concepts

Setion 2

- Process costing vs Job Cost

- Job cost part 1

- Job cost part 2

- Allocating costs to multiple products

- Departmental Overhead Rate

- Activity-Based Costing

Setion 3

- Cost Behavior

- Cost Behavior Continued

- Break Even Point

- Break Even Point Changes

- Sales Mix

- Pricing

- Short Term Decisions

Section 4

- Budgeting Intro

- Budgetin continued

- Operating Budgets

- Cash Budget

- Budgeted Balance Sheet

- Performance Evaluation

- Performance Evaluation Cont

- Standards

- Standard Costs Continued

Setion 5

- Capital Investment Decisions

- Capital Investment Analysis

Course 06: Diploma in Quickbooks Bookkeeping

- Getting prepared - access the software and course materials

- Getting started

- Setting up the system

- Nominal ledger

- Customers

- Suppliers

- Sales ledger

- Purchases ledger

- Sundry payments

- Sundry receipts

- Petty cash

- VAT - Value Added Tax

- Bank reconciliation

- Payroll / Wages

- Reports

- Tasks

Course 07: Theory of Constraints, Throughput Accounting and Lean Accounting

- The Theory of Constraints and Throughput Accounting

- Lean Accounting

- Summary and Lean Accounting Assignment

Course 08: Internal Audit Training Diploma

- Auditing as a Form of Assurance

- Internal Audit Procedures

- Technology-based Internal Audit

- Internal Control and Control Risk

- Audit Interviews

- Reporting Audit Outcome

- UK Internal Audit Standards

- Career as an Auditor

Course 09: Level 3 Tax Accounting

- Tax System and Administration in the UK

- Tax on Individuals

- National Insurance

- How to Submit a Self-Assessment Tax Return

- Fundamentals of Income Tax

- Advanced Income Tax

- Payee, Payroll and Wages

- Capital Gain Tax

- Value Added Tax

- Import and Export

- Corporation Tax

- Inheritance Tax

- Double Entry Accounting

- Management Accounting and Financial Analysis

- Career as a Tax Accountant in the UK

Course 10: Presenting Financial Information

- Presenting Financial Information

- The Hierarchy of Performance Indicators

- The Principle of Effective Reports

- Guidelines for Designing Management Reports

- Methods of Presenting Performance Data

- The Control Chart: Highlighting the Variation in the Data

- The Pareto Chart: Highlighting Priorities

- Exercise: The Control Chart

- An Example Management Report

- Interpreting Performance Data

- Supporting Colleagues by Giving Feedback

- Data Visualisation

- Final Thoughts on Presenting Financial Information

Course 11: Business Analysis Level 3

- Introduction to Business Analysis

- Business Processes

- Business Analysis Planning and Monitoring

- Strategic Analysis and Product Scope

- Solution Evaluation

- Investigation Techniques

- Ratio Analysis

- Stakeholder Analysis and Management

Course 12: GDPR Data Protection Level 5

- GDPR Basics

- GDPR Explained

- Lawful Basis for Preparation

- Rights and Breaches

- Responsibilities and Obligations

Course 13: Microsoft Excel Training: Depreciation Accounting

- Introduction

- Depreciation Amortization and Related Terms

- Various Methods of Depreciation and Depreciation Accounting

- Depreciation and Taxation

- Master Depreciation Model

- Conclusion

Course 14: Microsoft Excel Level 3

- Microsoft Excel 2019 New Features

- Getting Started with Microsoft Office Excel

- Performing Calculations

- Modifying a Worksheet

- Formatting a Worksheet

- Printing Workbooks

- Managing Workbooks

- Working with Functions

- Working with Lists

- Analyzing Data

Who is this course for?

Anyone from any background can enrol in this Xero bundle. Persons with similar professions can also refresh or strengthen their skills by enrolling in this course. Students can take this course to gather professional knowledge besides their study or for the future.

Please Note: This training program is designed to improve your Xero accounting skills, and has been curated independently without any affiliation with Xero Limited. While the program awards a CPD-accredited certificate upon completion, it's not an official certification from Xero.

Requirements

Our Xero is fully compatible with PC’s, Mac’s, laptops, tablets and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so that you can access your course on Wi-Fi, 3G or 4G.

There is no time limit for completing this course; it can be studied in your own time at your own pace.

Career path

Having this various expertise will increase the value of your CV and open you up to multiple job sectors.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.