Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

20 in 1 Career Action Plan Programme | 200 CPD Points| Free PDF & Hard Copy Certificate| 24/7 Support| Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

***24 Hours Limited Time Sale Offer***

Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme Enrolment Gifts:

FREE PDF & Hard Copy Certificate | PDF Transcripts | FREE Student ID | Enrolment Letter | Lifetime Access | Free Assessment

The gap between supply and demand for Accountants is widening as we speak! The statistics are insane! In a couple of years, the Accounting industry will have thousands more job openings in the UK alone, with a salary range of £30,000-£70,000.

This power-packed Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping programme features 20 in-depth courses, offering a Sea of knowledge and a Toolbox of skills. You will dive into the fundamentals, explore basics to advanced concepts, deep insights and gain the skills, blending the expertise of industry professionals.

Whether you're a beginner or a seasoned professional or a curious learner, this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle is what you need as it caters to all levels.

Wait, there is more! When you enrol in Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme, you'll receive 20 CPD-Accredited PDF Certificates, Hard Copy Certificates, and a student ID card, all absolutely free!

Courses In this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Career Action Plan Programme:

- Course 01: Xero Accounting – Complete Training

- Course 02: QuickBooks Online Bookkeeping Diploma

- Course 03: Sage 50 Accounts

- Course 04: Sage 50 Payroll Complete Course

- Course 05: UK Tax Accounting

- Course 06: HR, Payroll, PAYE, TAX

- Course 07: Introduction to VAT Online Training

- Course 08: Accounting & Bookkeeping Masterclass

- Course 09: Managerial Accounting Training

- Course 10: Level 4 Diploma Accounting and Business Finance

- Course 11: Corporate Finance: Working Capital Management

- Course 12: Financial Modelling for Decision Making and Business plan

- Course 13: Understanding Financial Statements and Analysis

- Course 14: Finance Assistant Training: Level 1 & 2 Certification

- Course 15: Making Budget & Forecast

- Course 16: Commercial Law

- Course 17: Anti-Money Laundering (AML)

- Course 18: Cost Control Process and Management

- Course 19: Advanced Diploma in Microsoft Excel

- Course 20: Microsoft Excel Training: Depreciation Accounting

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

CPD

Course media

Description

Start building your career with our Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme Right Away!

Dive into a comprehensive learning journey with the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme. Begin with the 20 foundational courses that provide a solid understanding of the core concepts. Once you've established a strong base, advance your knowledge further on as you go through each and every course.

All the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping courses are designed to equip you with the specific tools and techniques needed to thrive in your desired career path. Whether you're a complete beginner or looking to sharpen your existing skills, this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping programme has everything you need to achieve your goals

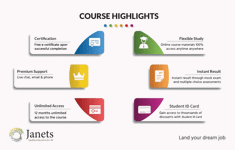

Standout features of this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme

- The ability to complete the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme at your own convenient time

- Facility to study Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme from anywhere in the world by enrolling

- Free CPD Accredited Certificate upon completion of Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme

- Get a free student ID card with the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme

- Lifetime access to the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme materials

- Get instant access to this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme

- 24/7 tutor support with the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme

Certification

You have to complete the assignment given at the end of the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme. After passing the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping exam, you will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards. COMPLETELY FREE OF COST!

Disclaimer: This self-paced course aims to improve your knowledge and understanding of the Xero accounting software. Please note that this training programme is not associated with Xero Limited. Upon successful completion of the course, you will receive a CPD QS certificate, not an official Xero certification.

Who is this course for?

This Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme is the go-to for:

- Students seeking mastery in Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

- Professionals looking for a Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping related career.

- Individuals seeking to enhance Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping skills

- Individuals who are already employed and wish to climb up their career ladder in the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping industry

- Anyone passionate to learn about Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

- Anyone who values flexible, self-paced learning from the comfort of home

Requirements

This Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Programme requires no prior experience and learners from any background can enrol in the course. All you need is a device and an internet connection!.

Career path

After Completing this Programme, you can pursue the following career path:

- Bookkeeper (20,000 to 35,000)

- Payroll Specialist (25,000 to 40,000)

- Accounting Technician (25,000 to 40,000)

- Tax Advisor (30,000 to 60,000)

- VAT Specialist (30,000 to 55,000)

- Financial Accountant (35,000 to 65,000)

- Management Accountant (35,000 to 70,000)

- Financial Controller (45,000 to 90,000)

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.