Xero Accounting - CPD Certified

Academy for Health & Fitness

Super Saver Offer! Complete Training | CPD Accredited | Audio Visual Training | Free ID Card & Assessment Included

- 11 students

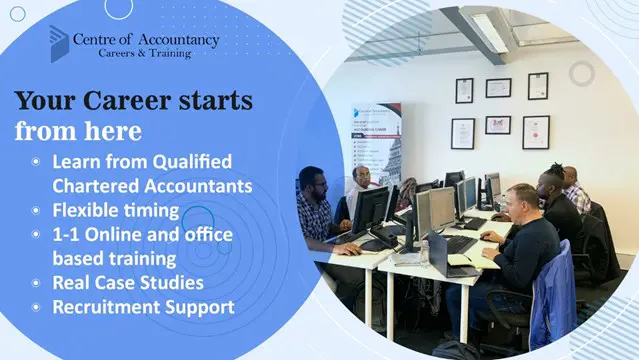

- Online

- 4 hours · Self-paced

- 10 CPD points

- Tutor support

Great service

...created to develop your Xero accounting skills and the overall understanding of the software. It has no association with Xero Limited and operates independently. Please note, that the certificate you receive upon completion is CPD accredited and not an official Xero certification. The

…