Accounts Assistant Training Practical Training on Sage 50, QuickBooks and Xero

KBM training

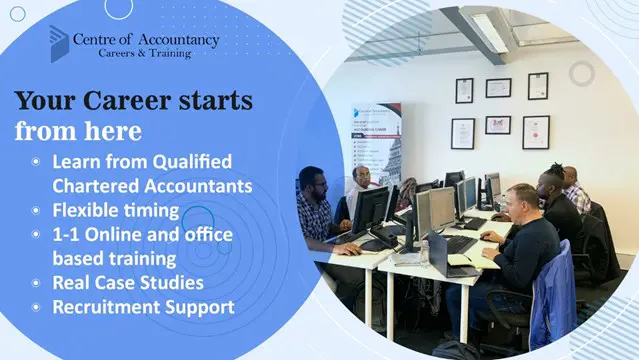

Accounts Assistant Training

- 1,913 enquiries

- Online

- 166 hours · Part-time

- Certificate(s) included

- 32 CPD points

- Tutor support

...Submissions, Journals & Adjustments and Management Accounts. We are official partners with Sage, QuickBooks and Xero and all our trainees get official Sage, QuickBooks and Xero certifications upon completion of Accounts Assistant training. We are also a recruitment firm and we help each

…